Companies are switching to electric vehicles en masse, this brings new changes for both employers and employees. One such change is the shift from traditional fuel cards to a charging card for electric vehicles

Is there also a 'fuel card' for electric company cars?

Yes, this exists! Employees can perfectly have the cost of electric vehicle charging session reimbursed by their employer. This can be calculated based on the actual cost of electricity consumed by the employee for charging their EV. At public charging points, use is made of a charge card which records each session and automatically pays for the employee. Charging sessions at employees' homes can also be reimbursed by the employer. You can read more about how this process works correctly in this article.

How do you repay charging costs to employees?

If an employer offers both a company car and a charge card and the charge card is only used for charging the company car, the taxable benefit is limited to the company car. This means you will only have to pay Benefit of All Nature (VAA). for the company car.

Moreover, companies can deduct certain costs of the charge card, electricity and even home installations from corporate tax. You can find more info here.

If the employee also gets a home charging point and the employer reimburses the electricity costs, similar tax treatment applies as for a company car with fuel card.

There are two main conditions:

The charging station must be smart and thus have an intelligent communication system that lets the employer know how much electricity is being used to charge the car.

In addition, a proper charge rate should be determined for the reimbursement of electricity.

When employers reimburse home charging stations, the employer determines the reimbursement rate. If the company chooses the reimbursement rate based on the CREG-tariff, this specific tariff applies for the period in question. In a nutshell: the CREG tariff is the average price of electricity in one specific month. This tariff therefore varies from month to month.

What are the steps for reimbursement of charging fees?

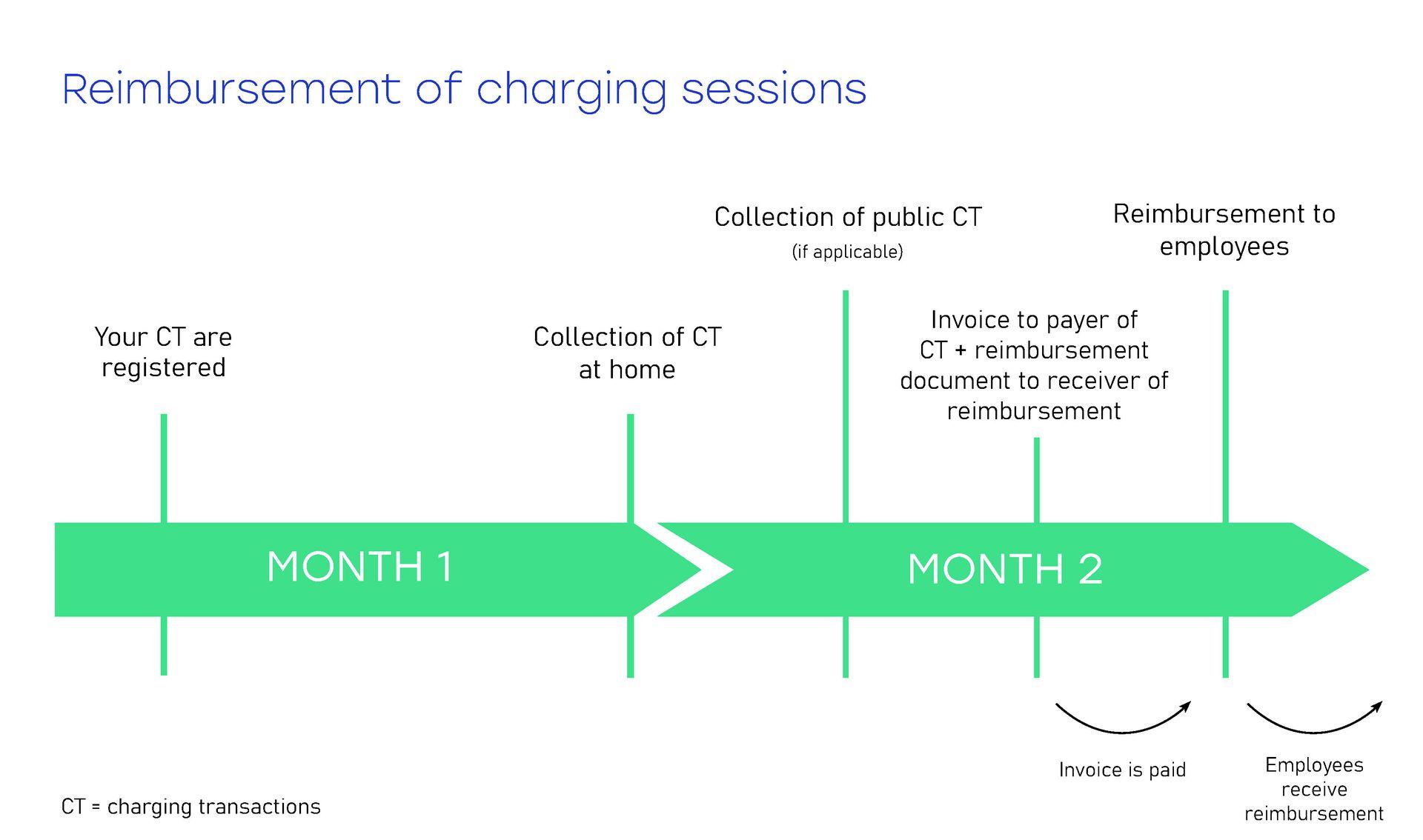

Reimbursement of electricity charges is done based on the actual cost. This is how this process works if you choose an Energy Package and charge the employee with a charging station at home.

The employee uses his charging station at home to charge his electric car. He then simply pays the electricity bill of his private residence first.

All charging transactions are recorded per month and forwarded per employee to the charging station provider such as e.g. Pluginvest

The charging station provider prepares an invoice and sends it to the employer, who then pays the invoice.

After the employer pays the invoice, the employee receives the refund for his charging session, automatically credited back to his account.

How is reimbursement done when employees use public charging stations?

When employees want to use public charging stations, they need a Charge@Public charging pass This card provides access to a wide network of more than 450,000 charging stations across Europe. The employer can reimburse charging costs by using this charging card, which records every charging session of the employee for smooth reimbursement. For this, the employee does not receive a refund as the costs are directly covered by the employer.

So just like before with the familiar fuel card, it is now possible to reimburse your employees' charging costs for the home charging station and employees can also charge publicly with a charging card. This is all automatically taken care of for your company and employees if you choose a charging station provider that offers the extra services.

Pluginsights

Find out all about the EV Sector and gain new insights into the transition to eMobility.